ATO Tax Time Update

JobMaker Hiring Credit

JobMaker Hiring Credit

With the second claim period for the JobMaker Hiring Credit ending on 31 July 2021, the ATO is reminding businesses to check if they’re eligible to participate in the scheme. Employers can receive up to $10,400 over a year for each new job they fill between 7 October 2020 and 6 October 2021 with an eligible employee aged 16 to 29 years, and $5,200 over a year for each eligible employee aged 30 to 35 years.

To receive JobMaker Hiring Credit payments, employers must complete three steps:

- register for the scheme

- nominate their additional employees through Single Touch Payroll (STP)

Tax Time

Recording JobKeeper payments at tax time

Did you know that JobKeeper payments are taxable? If you’ve received any JobKeeper payments this financial year, you’ll need to include them in your 2020–21 income tax return. Your accounting method will also affect the total JobKeeper payments that need to be included in your tax return.

Occupation guides to help you at tax time

The ATO is focused on helping employees get their work-related expenses right this tax time. They have 39 Occupation specific guides that will help your employees understand what they can and can’t claim this tax time.

Small Business support at tax time

Small Business support at tax time

Are you a sole trader who has received JobKeeper payments for yourself and any eligible employees this financial year? From early July, you’ll be able to access the total amount of JobKeeper payments you’ve received through Online services for business, myTax or your registered tax agent. The amount will be provided as ‘information only’ and will not be mapped to a label.

Find out more about where to report these payments here: ato.gov.au/SBsupport

Small Business

Single Touch Payroll

A number of Single Touch Payroll (STP) reporting concessions are changing from 1 July. One of these changes is that amounts paid to closely held payees from 1 July 2021 will need to be reported through STP. However, small employers (with 19 or fewer payees) will still have access a number of concessional reporting options for closely held payees. A recording of a recent ATO webinar about small employers’ reporting options for closely held payees from 1 July is now available. Employers are also reminded that the Single Touch Payroll (STP) finalisation declaration for 2020–21 is due 14 July 2021. If employers have any closely held payees, they have a later due date for those payees only. This message was included in a Small Business news article published earlier this month.

Simplifying eligibility for the loss carry back tax offset

The ATO has recently released a simple fact sheet to help you work out whether you are eligible to claim the loss carry back tax offset in your 2021 and 2022 company tax returns.

TFE and LCB labels now available in 2021 tax returns

From 1 July 2021, the ATO will be removing the substituted accounting period and part year lodger forms for temporary full expensing (TFE), backing business investment, and loss carry back (LCB) from their website. Instead, you can now claim by completing the additional labels the ATO has added in the 2021 income tax returns.

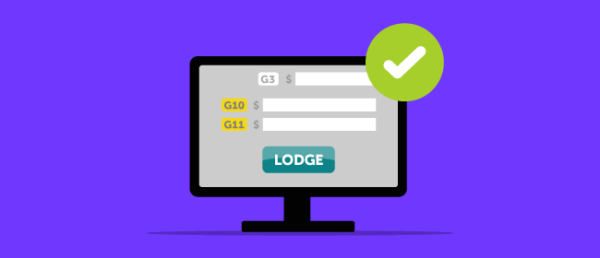

Lodge your BAS in Online services for business

Lodge your BAS in Online services for business

Try Online services for business for your next quarterly BAS, due 28 July. Plus, check out these tips to help get your BAS right!

Protecting honest businesses from unfair Electronic sales suppression tools (ESSTs)

The ATO is continuing to support honest businesses, helping to maintain a level playing field by dealing with behaviour that contributes to the Shadow economy. ESSTs have been identified as contributing to the Shadow economy. They are used to evade tax, creating unfairness in our tax system. For more information, visit ato.gov.au/ESST.

The ATO also have the following audio grabs: Shadow economy: video and audio grabs.

A guide to all thing’s concessions

Are there any concessions you may be able to take advantage of? To find out more about the latest changes to concessions, such as different tax depreciation incentives including temporary full expensing and instant asset write-off, visit ato.gov.au/SBwhatsnew. For a summary of available concessions, visit ato.gov.au/concessionsataglance

Make record keeping your new financial year goal!

Make record keeping your new financial year goal!

What worked well for your record keeping this past financial year? Is there anything you’d like to do better? You can claim the cost of record-keeping software as a deduction, so it could be something to consider before the end of financial year to set yourself up for the year ahead. Find out more about how to choose suitable record-keeping software at ato.gov.au/electronicrecordkeeping

Keeping across your study or training support loan requirements

Do your employees have study or training loans? On 1 July, the minimum income threshold for repayments increased. This means employees who have a student loan may need to make compulsory repayments once they start earning more than $47,014 per year. Help them get it right – make sure your payroll is right using the latest study loan tax tables at Study and training support loans.

Master Electricians can access unlimited direct access to Employer Advice , Technical, and Safety teams. Some of the many benefits of becoming a Master Electrician. Phone 1300 889 198 today.